Professor Jorge Sá (PhD Columbia University; MBA Drucker University; Jean Monnet Chair; Peter Drucker speaker) recently published the article “Industrialization is not the solution to create wealth” on the academic blind-referee Journal of Social, Political and Economic Studies (USA), Vol. 47, No. 3-4 (Fall-Winter 2023).

This article provides strong empirical evidence contrary to what many economists argue: that industrialisation is the key to wealth creation, especially in more developed countries.

However, as the article shows, this relationship is non-existent and income and growth depends on the value added created, regardless if the sector is agriculture, industry, service or technology.

———

Jorge Sá recently retired from Professor at IESE associated AESE (site: www.aese.pt).

He is a Peter Drucker expert and a speaker on Peter Drucker, with whom he studied and who offered letters of recommendation for his books and endorsements for his work.

His books have been translated into twelve languages, published over thirty articles in blind refereed academic reviews and journals, has addressed conferences and given seminars at several institutions (e.g. TED USA – https://youtu.be/SOkjPVi1Fts –, London Business School, Oxford, IESE, George Washington University, Peter Drucker Society of Europe, European Commission, etc.), and has worked as private consultant, non-executive director or taught in the executive programs of multinational companies such as: Coca-Cola, SHELL, Unisys, IBM, Glaxo, British Petroleum – BP, Makro (Metro group), Intermarché, Scottish & Newcastle, Sara Lee, Total, Johnson & Johnson, Pfizer, Henkel, McDonald’s, UnitedHealth group, Vodafone, Merck, Volkswagen Group, Microsoft, etc.

He speaks and writes (by alphabetical order) English, French, German, Portuguese and Spanish.

His hobbies are soccer (degree as professional coach) and the relation between military history (battles) and business administration, having written several books on the topic.

For more information on Professor Sá’s conferences please check our website at: https://www.vasconcellosesa.com/public-speaking/conferences/ or contact us at associates@vasconcellosesa.com .

Read the full article below:

Authors: Jorge Sá; Ana Lúcia Luís

INDUSTRIALIZATION IS NOT THE SOLUTION TO CREATE WEALTH

Abstract:

Many economists argue that industrialisation is the key to wealth creation, especially in more developed countries. However, this relationship is not direct and wealth and economic growth depend on other aspects, such as the type of activities generated within the economic sectors that will impact on the degree of value added generated. In fact, when it depends on quality and/or delivery; or in the case of price when the activity is carried out with such a degree of efficiency that high productivity levels can compensate for the low sale price, it is shown that industrialisation per se is not the key to wealth creation nor the source of economic growth.

The impact of reindustrialization in the economy

The slower economic growth among many OECD countries has led many economists and politicians to defend (re)industrialization as the solution. That national income per capita would depend on the weight of the manufacturing sector relative to other economic sectors.

Several studies analyze the role of reindustrialization for developed economies [(Krawczyński, Czyżewski & Bocian, 2016); (Kornev, Maksimtsova & Treshchina, 2018)]. The role and importance of this process can be analyzed in different perspectives and focuses such as environmental impact (Cherniwchan, 2012), resources sustainability (Chaitanya, 2007) or to achieve international competitiveness and to increase job creation in countries (Moczadlo, 2020).

Economies have four main sectors. The primary (agriculture and extraction); the secondary (transformation of products); the tertiary (services); and the most recent one, the knowledge-based sector: internet, e-services, etc. And nowadays many developed countries have two characteristics: the relative weight of industry in the national income is low as the manufacturing of products is increasingly transferred to the third and fourth worlds, which assume the role of the world’s factory (Iqbal, Salam & Nosheen, 2018). Simultaneously, the other characteristic is stagnation, the so-called Japanese disease: low growth rates [(Posen, 1998); (Horioka, 2006)].

Since the two factors go together, low growth rates and low importance of industry, many economists have defended that there is a cause-effect relation: that de-industrialization is the reason for low growth [(Hutchison, Ito & Westermann, 2006); (Morgon, 2019)].

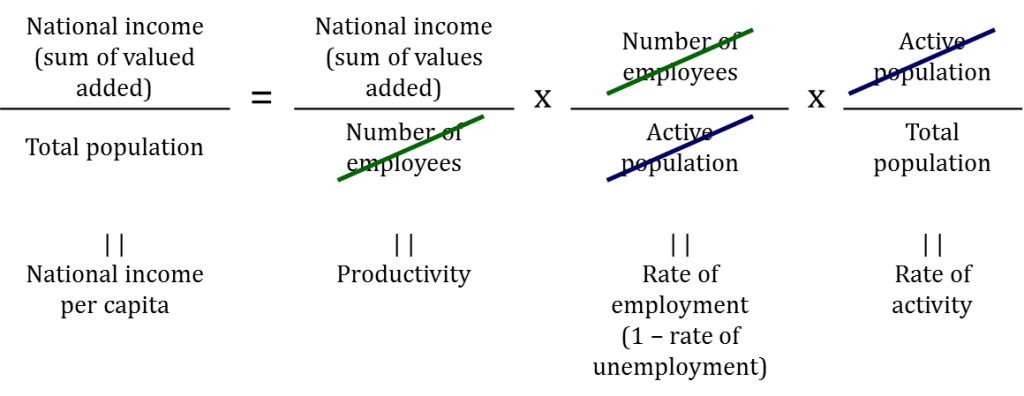

As is known, one of the ways to compute GDP is by adding the value added of firms, being value added the difference between sales and purchases from outside, that is the inputs of raw materials, parts, components, etc. The other is by adding the remuneration of all resources: labour (wages), land (rents) and capital (interests and profits). And then there is productivity, usually defined by the value added per employee. Finally, national income per capita can be higher for several factors: not only productivity is high, but also when the percentage of employees in the active population is also high (there is low unemployment) and the active population (those willing to work) are a large percentage of the total population. Indeed, as can be seen in the right side of the formula below, both the number of employees (lines in green) and active population (lines in blue), cross out as they appear in the numerator and denominator. Considering the formula to be:

So, both productivity and national income per capita, they come down to value added. That is what is critical. Thus, the question: is there anything intrinsic to industry, in its essence, which induces its value added to be (necessarily) high? Or to facilitate considerably the creation of high value added per employee? (Rahman, 2017). According to Szirmai (2012), the theoretical answer appears to be no. After all, if one sells low price textiles, value added is low; if one sells fashion (Gucci, Versace, etc.), value added is high. And both belong to the industrial sector. Regarding the service sector, if a country’s hospitality business (e.g.) is composed mostly of motels and two- and three-stars hotels, then value added is low; but if hotels are primarily five stars, luxury, charm hotels, then value added is high. And all belong to the service sector. That means that there are high and low value-added goods both in products and services.

Whatever, and that regardless of the sector, value added is a consequence of applying scarce resources to goods which are sold because of their quality (intrinsic or image) or/and delivery, and not based on their cost, price.

It could be however (for some reason) far easier to create high value goods in manufacturing rather than in services. If so, the richest countries would have a greater relative weight of industry in the national income, than the poorer ones. Then, between both variables there would be a correlation 1) positive, 2) high (close to +1), and 3) statistically significant. Does empirical evidence support that?

The empirical evidence

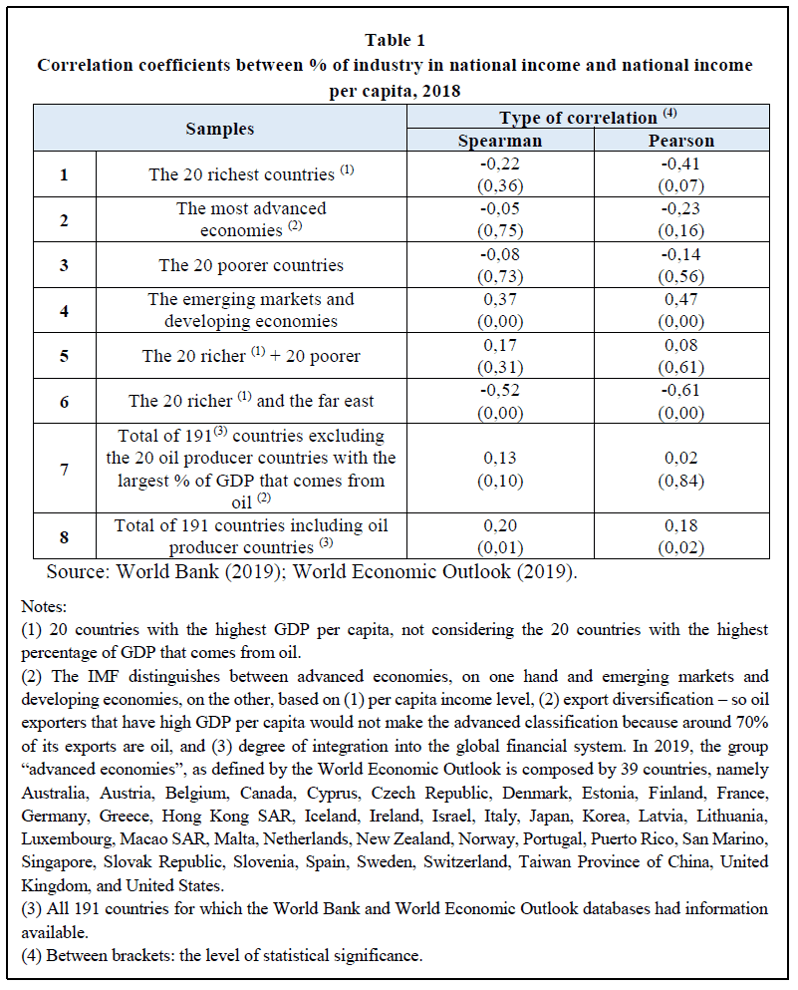

Table 1 presents the correlation coefficients Spearman (rank, order) and Pearson (cardinal) for several samples of countries[1] starting with smaller samples where, by being countries more homogeneous, it is harder to expect strong and significant correlations. The samples considered are:

1st – The 20 richest countries;

2nd – The most advanced economies[2];

3rd – The 20 poorer countries;

4th – The emerging markets and developing economies;

And then moving into more diverse samples:

5th – Both the 20 richer and poorer;

6th – The 20 wealthier and the far east;

And finally, into larger samples of:

7th – Total of 191 countries[3], excluding and

8th – Including oil producer countries.

As can be seen, the correlation coefficients in figure one are only 1) positive, 2) high and 3) statistically significant in lines four (sample of emerging markets and developing economies) and partially in eight: the total sample of countries, where only the Spearman (rank/order) but not the Pearson (cardinal) correlation is significant. In all other cases they are low and with a high probability of being due to chance.

Sometimes the correlations are even negative and statistically significant, indicating that – contrary to the argument – the higher the industry percentage in national income, the lower its per capita. That is the case with the Pearson correlation on the first line (sample of 20 richest countries): the less manufacturing, the higher the income.

So, in general, not only the data does not support that there is a positive relation between the importance of the industry and a country’s wealth, but also there is an indication that among the twenty richest countries it is the opposite which happens. But why the two exceptions (in lines four and eight)?

Explaining the exceptions

Analysing the exceptions and starting with line four (emerging markets and developing economies), these are countries whose economy is based in 1) agriculture, 2) with family farms, 3) using traditional methods, 4) frequently exploiting small lots.

When industry is introduced, even if factories produce low-cost items, that represents nevertheless an improvement in terms of value added by employee (productivity) and inhabitant (per capita). Also, some of those factories are managed directly or at least to some degree controlled by first world multinationals, which bring to those manufacturing units its management expertise (Ghani, 2011).

Then there is a second exception: line eight, the total sample of countries, and here the correlation is positive and significant (at a 5% probability of being due to chance) in the Spearman/rank/order coefficient, but not in the Person/cardinal (lower value – here the probability of being due to chance is 15%). An explanation may be that the sample includes oil producing countries. Oil is a high value commodity. And the petroleum industry involves not only extraction (primary sector), but also refining and distributing its by-products, gasoline, diesel, etc. (secondary sector). Indeed, when the exceptional impact of oil is considered by removing the oil rich countries from the sample (the 7th line in figure one), the values of both the (Spearman and Pearson) correlations fall and become non-significant.

Conclusions

According to Table 1, except in the case of very poor economies shifting from traditional, family based agricultural units to factories (frequently managed by first world companies) and the oil effect, there is no relation, whatsoever, between wealth and industry. And on the contrary: among the twenty richest countries, the importance of manufacturing is associated with lower income per capita.

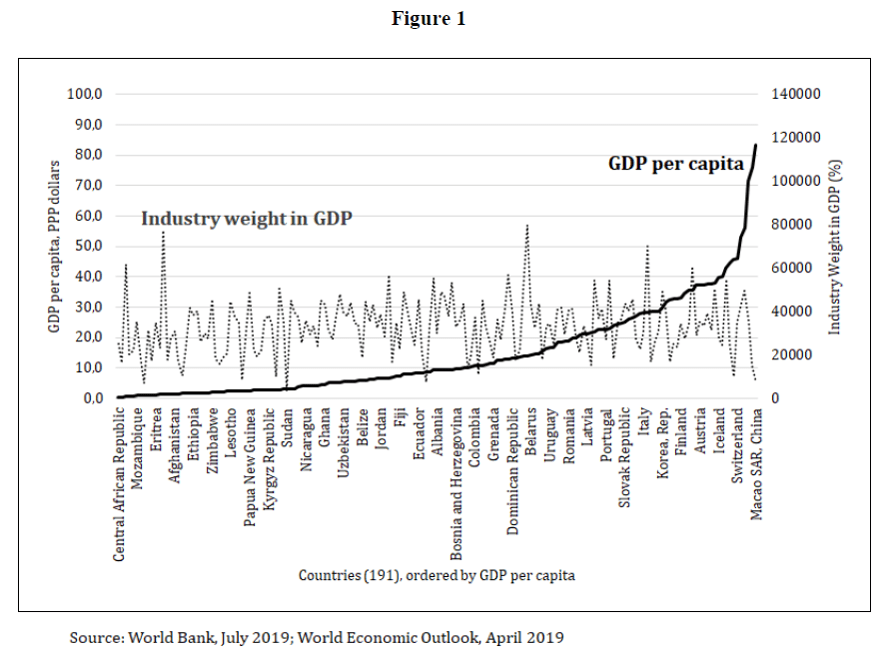

Figure 1 (that uses the gross domestic product and not national income for reasons of data availability) enhances that if there was a relation, as the country’s wealth per capita increase from the left to the right (in black), the industry weight in economy (dotted line) would move in parallel, or at least in the same way. But that is not what happens. The bold and dotted lines do not have the same trend.

And so, that brings us to the beginning of the article. Wealth and growth seem to be dependent not on the type of economic sector, but on the type of activity within it: the degree to which its value added is high.

What happens when one relies on quality and/or delivery; or in the case of price when the activity is performed with such a degree of efficiency that the high levels of productivity can compensate the low sales price. In any case, (re)industrialization per se, is not the key to wealth, neither the source for economic growth.

References:

Chaitanya V., Krishna. 2007. “Rapid Economic Growth and Industrialization in India, China & Brazil: At What Cost?”. William Davidson Institute Working Paper No. 897.

Cherniwchan, Jevan. 2012. “Economic growth, industrialization, and the environment”. Resource and Energy Economics, 34(4):442-467

Ghani, Ejaz. 2011. “The Service Revolution”. Paper presented at ILO Conference, Geneva.

Horioka, Charles Yuji. 2006. “The causes of Japan’s ‘lost decade’: The role of household consumption”. Japan and the World Economy, 18(4): 378-400.

Hutchison, Michael M., Takatoshi Ito, Frank Westermann. 2006. “The great Japanese stagnation: lessons for industrial countries”. Japan’s Great Stagnation Financial and Monetary Policy Lessons for Advanced Economies. Cambridge, Massachusetts: 1-32.

Iqbal, Javed, Muhammad Salam, Misbah Nosheen. 2018. “Determinants of Services Sector Growth: A Cross Country Analysis”. Pakistan Journal of Applied Economics, 28(1): 191-210.

Kornev, A. K., S. I. Maksimtsova, S. V. Treshchina. 2018. “Reindustrialization as an Opportunity to Grow the Domestic Economy”. Studies on Russian Economic Development, 29(4): 392-398.

Krawczyński, Michał, Piotr Czyżewski, Karol Bocian. 2016. “Reindustrialization: A challenge to the economy in the first quarter of the twenty-first century”. Foundations of Management, 8(1): 107-122.

Moczadlo, Regina. 2020. “Re-industrialization to foster growth and employment in the European Union”. Ekonomski Vjesnik, 33(1): 39-58.

Morgon, Jason. 2019. “Review of The Origin of the Prolonged Economic Stagnation in Contemporary japan: The Factitious Deflation and Meltdown of the Japanese Firm as an Entity”. Quarterly Journal of Austrian Economics 22, no.3: 477-85.

Posen, Adam. 1998. “Some Background Questions on Japanese Economic Stagnation”. Briefing Memo submitted to the Trade Subcommittee, Committee on Ways and Means, US House of Representatives. Internet document (fox. rollins. edu/~ tlairson/japan/JPNECON. HTM), July, 13.

Rahman, Ahmed. 2017. “A Simple Theory of the Effects of Industrialization”. Macroeconomic Dynamics, 21(1): 106-129.

Szirmai, Adam. 2012. “Industrialisation as an engine of growth in developing countries, 1950-2005”. Structural Change and Economic Dynamics, 23(4): 406-420.

World Bank, database. 2019.

International Monetary Fund. 2019. World economic outlook. Washington, D.C.

[1] The years 2019 and 2020 were excluded from the analysis to avoid the impact of the Covid crisis.

[2] The IMF distinguishes between advanced economies, on one hand and emerging markets and developing economies, on the other, based on (1) per capita income level, (2) export diversification – so oil exporters that have high GDP per capita would not make the advanced classification because around 70% of its exports are oil, and (3) degree of integration into the global financial system. In 2019, the group “advanced economies”, as defined by the World Economic Outlook is composed by 39 countries, namely Australia, Austria, Belgium, Canada, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong SAR, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Macao SAR, Malta, Netherlands, New Zealand, Norway, Portugal, Puerto Rico, San Marino, Singapore, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Taiwan Province of China, United Kingdom, and United States.

[3] All 191 countries for which the World Bank and World Economic Outlook databases had information available.